Click ![]() on the toolbar or press Alt-N.

on the toolbar or press Alt-N.

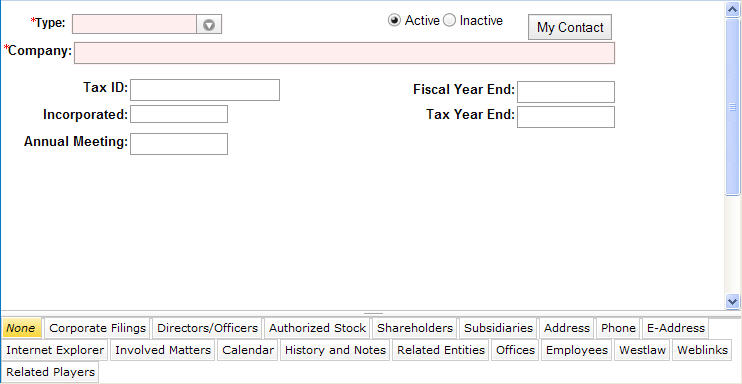

Note: The Corporate Secretary notebook contains a main (header) section and a binder section that contains a number of tabs. The tabs are used to view, enter, and manage additional information pertaining to the record displayed in the header. The data entry instructions below pertain to the main (header) section of the Corporate Secretary notebook. For an explanation of the data entry requirements for the tabs, refer to Corporate Secretary Notebook Tabs Overview.

To create a corporate secretary record:

Click ![]() on the toolbar or press Alt-N.

on the toolbar or press Alt-N.

In the Type field, select the corporate entity type from the dropdown list.

In the Company field, enter the legal name of the corporate entity.

In the Status field, select the appropriate value. The default value is Active.

Note: In order to add a record, LawManager requires entry of the fields indicated above. All other fields are optional but, depending on the requirements of your organization, can be entered if the information is available. Note that some fields may not display, depending on the type of entity. To add and save the record now, go to step 11. To add optional data, continue with step 6.

In the Tax ID field, enter corporate entity's tax ID number. If the corporate entity is a foreign company, enter the foreign ID number.

In the Incorporated field, enter the date the corporate entity became a legal corporation.

In the Annual Meeting field, enter the date the annual stockholder's meeting is held. Note that this can be a specific calendar date or a relative date (e.g., Third Thursday in October).

In the Fiscal Year End field, enter the date the corporate entity's fiscal year ends. Note that this can be a specific calendar date or a relative date.

In the Tax Year End field, enter the date that designates the end of the year for tax reporting purposes. This date is usually December 31, but another designated date can be entered. You also may enter a relative date.

Click ![]() to save the record.

to save the record.