The LEDES format used by the law firm/vendor determines how line item vs. invoice-level discounts may be submitted and subsequently imported into eCounsel. The LEDES 1998B Field Specification , LEDES 1998BI Field Specification, and LEDES 2000 (L2K) XML Format documents published by the LEDES organization (http://www.ledes.org) were used as references.

To Include a Discount in a LEDES 1998B or 1998BI File:

Discounts may be input on individual fee line items and are indicated in the Line_Item_Adjustment_Amount field. For example, if a timekeeper had a billing rate of $200 per hour and he/she worked on a matter for two hours, but the client is entitled to a 10 percent discount on that person’s time, the associated field values (among others) would be as follows:

|

Field Name |

Field Value |

|

EXP/FEE/INV_ADJ_TYPE |

F |

|

LINE_ITEM_NUMBER_OF_UNITS |

2 |

|

LINE_ITEM_ADJUSTMENT_AMOUNT |

–40 |

|

LINE_ITEM_TOTAL |

360 |

|

LINE_ITEM_UNIT_COST |

200 |

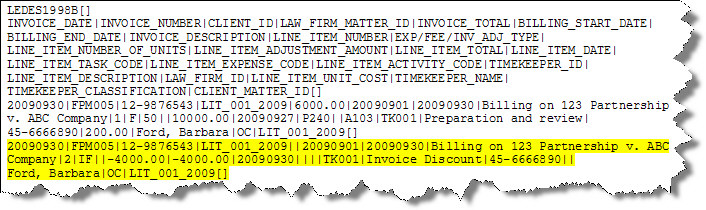

Discounts also may be input as invoice-level adjustments and must be entered as a separate line item with the EXP/FEE/INV_ADJ_TYPE field indicating either an invoice-level adjustment to fees (IF) or an invoice-level adjustment to expenses (IE). The value for the discount is entered in the LINE_ITEM_ADJUSTMENT_AMOUNT field. However, eCounsel imports the IF line as an invoice-level fee discount and an IE line as a line item expense discount.

Thus, an invoice-level adjustment in the amount of -$4,000 on fees (i.e., an invoice-level discount) would have the following field values (among others):

|

Field Name |

Field Value |

|

EXP/FEE/INV_ADJ_TYPE |

IF |

|

LINE_ITEM_ADJUSTMENT_AMOUNT |

–4000 |

|

LINE_ITEM_TOTAL |

–4000 |

The assumption is that each invoice in the LEDES 1998B or 1998BI file will contain only one IF line and only one IE line. If more than one invoice-level discount line on fees is found, the invoice will be rejected. An example file with an invoice-level discount is as follows:

To Include a Discount in a LEDES 2000 File:

Discounts may be input on individual fee or expense line items and are indicated by the difference between the Base_Amount and Total_Amount fields. For example, if a timekeeper had a billing rate of $200 per hour and he/she worked on a matter for two hours, but the client is entitled to a 10 percent discount on that person’s time, the associated field values (among others) would be as follows:

|

Field Name |

Field Value |

|

Units |

2 |

|

Rate |

200.00 |

|

Base_Amount |

400.00 |

|

Discount_Type |

Percent or Flat or “” |

|

Discount_Amount |

40.00 |

|

Total_Amount |

360.00 |

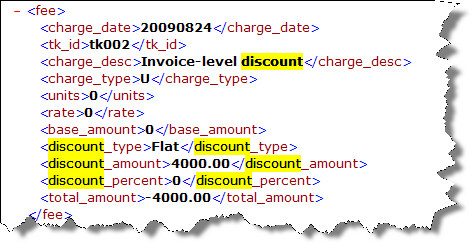

Discounts also may be input as invoice-level discounts. The LEDES standard specifies using the inv_generic_discount field in the INVOICE segment; however, eCounsel does not support this standard. eCounsel requires that invoice-level fee discounts be entered as a separate line item. Therefore, the following format is recommended for an invoice-level discount in the amount of –$4000 on fees:

|

Field Name |

Field Value |

|

Units |

0 (import task expects a number) |

|

Rate |

0 (import task expects a number) |

|

Base_Amount |

0 |

|

Discount_Type |

Percent or Flat |

|

Discount_Amount |

4000.00 |

|

Total_Amount |

–4000.00 |

The assumption is that each invoice in the LEDES 2000 file will contain only one invoice-level discount line on fees. If more than one invoice-level discount line on fees is found, the invoice will be rejected. An example file with an invoice-level discount is as follows: