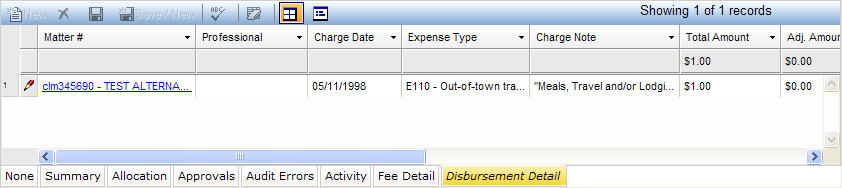

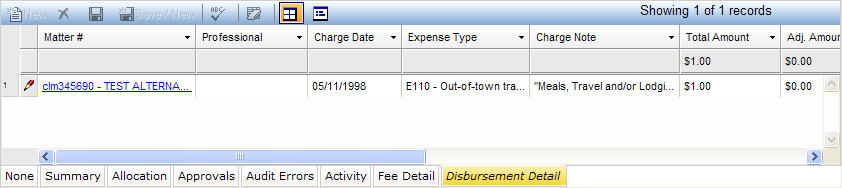

The Disbursement Detail tab is used to view the disbursement detail for electronic invoices. Adjustments to a detail record can be made on the adjustment fields. All other fields are read-only.

Key features:

UTBMS expense code dropdown.

Pop-up calendar for the charge date.

Pop-up notepad for the fee description.

Smart professional dropdown with partial name searching and button to launch the Entity notebook.

Smart matter dropdown with matter number or partial matter name searching and button to launch the Matter notebook.

Original, discounted, adjustment, and actual financial fields.

Note: This tab does not display for manual invoices.

The Disbursement Detail tab, which is accessed by clicking on the tab in the binder section of the Invoices notebook, displays in tabular view as described below.

|

Field |

Description |

Required (Y/N) |

|

Matter # |

The matter with which the expense is associated. |

Y (read-only) |

|

Professional |

The name of the professional who claimed the expense. |

Y |

|

Charge Date |

The date of the expense. |

Y |

|

Expense Type |

The type of expense. Select a value from a dropdown list. |

Y |

|

Charge Note |

This field contains a short note regarding any expenses for this invoice. Click |

N |

|

Total Amount |

The total amount of the detail record. |

N |

|

Adj. Amount |

The amount of the adjustment. |

N |

|

Original Unit Amount |

The original unit amount of the expense before any adjustments or discounts. |

Y |

|

Original Units |

The original number of units of expense before any adjustments or discounts. |

Y |

|

Original Total |

The original total amount of expense before any adjustments or discounts. |

Y |

|

Discount Type |

The type of discount associated with the expense. |

N |

|

Discount Percent |

The percentage of the discount to apply to the expense. |

N |

|

Discount Amount |

The amount of the discount. |

N |

Note: LawManager tab records include fields containing audit and security information. For a detailed explanation of these fields, see Viewing Audit Fields and Security Information.